Top 5 Liquidity Pool Trackers and Analytics

-

Don´t miss any DeFi, NFT or Web3 insights. Get involved in DeFi & NFTs & Web3 for free!

Top 5 Liquidity Pool Trackers and Analytics

- Managing the own Liquidity Pools (LPs) is in general a time-consuming and usually tiresome task. You need to stay up to date in the fast-moving Liquidity Pools ecosystem. Liquidity Pool trackers and analytic services make your life easier by helping you to make better LP decisions and help you to manage your LP exposure! Below you will find the Best 5 Liquidity Pool Trackers and Analytics 2022.

- Liquidity Providing can bring you attractive returns, but we recommend learning (check this video) everything about LPs before using your funds.

- In this blog post, we share the Top 5 Liquidity Pool Trackers and Analytics with you.

-

Make better Liquidity Pool (LPs) decisions with LP Analytics and Data service providers!

What is a Liquidity Pool (LP)?

- In a decentralized world the liquidity for financial assets and the market making service will be not provided by a central entity. In the upcomgin DeFi ecosystem the liquidity for digital assets come from liquidity pools. These liquidity pools are the trading pairs on automated market makers (AMMs), they are creating a liquid market.

- How does Liquidity providing work? Acitve DeFi users deposit two tokens of equal value. E.g. 50% UST (the Stable coin of the Terra ecosystem) and 50% Ethereum (ETH) into the UST/ETH pool to add liquidity. You add the liquidity by managing your wallet and signing transaction and deposit your 50%/50% token value to the pool. The pool is a automated smart contract structure.

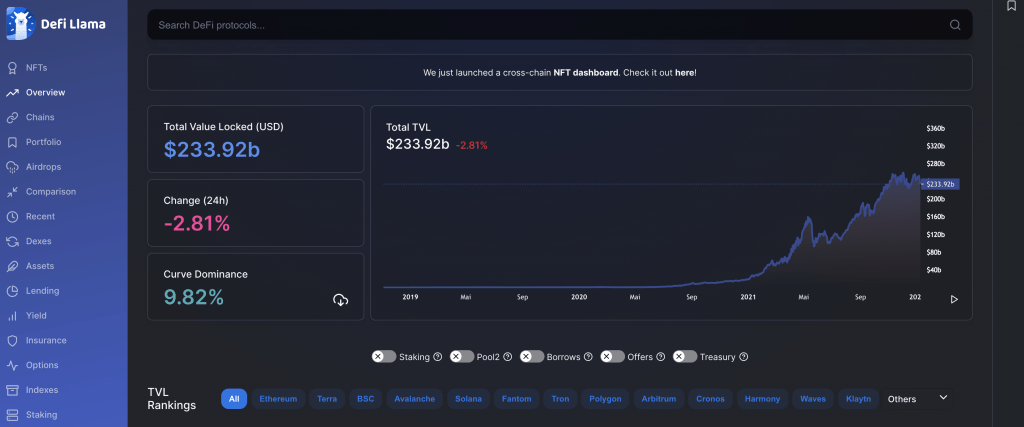

- When we talk about liquidity in Liquidity Pools the expression “Total Value Locked” (TVL) is important, it show the value of tokens which is locked in amongst others in liquidity pools.

- Here you can check the TVL at DeFiLlama. The current TVL (08.01.2022) is at 233 billion USD and growing on a constant basis.

-

DeFiLlama Dashboard - The more liquidity a pool receives from different LPs the more liquidity is aggregated in the pool and it reduces the slippage for the trading pair. Slippage is the difference between the expected price of the trade and the price when the trade gets executed.

- Some of the Automated Money Markets (AMMs) allow the active users to deposit more than two tokens, e.g. Balancer.

- What can you earn by providing liquidity? The reward for providing liquidity is a percentage of the trading fees relative to your share of the pool, e.g. 0,3 percent trading fees. In some cases, AMMs will incentivize users with their governance token. The governance token is the native protocol token and it is distributed to the active LPs. For example, users of Balancer earn BAL with their percentage of trading fees. These two components create your LP returns.

- DezentralizedFinance.com is a huge fan of the Liquidity Pool ecosystem and we recommend that you should learn about Liquidity Providing and Liquidity Pools, we believe it will be a hot topic for the next upcoming +10 years.

What is a Liquidity Pool (LP) Tracking and Analytics Service?

- A Liquidity Pool data analytics and tracking tool will track the performance (APY and APR), returns and risk data of different liquidity pools (LPS) or your active liquidity pool deposits. In most cases, the Liquidity Pool tracking services provide analytics features. The returns of Liquidity pools are changing every minute, be aware that you need to check our position regularly. Read also our Risk Disclaimer, as Liquidity Providing can be very risky.

- Don´t miss any Liquidity Pool (LPs) insights. Get involved in DeFi & NFTs & Web3 and LPs for free!

Top 5 Liquidity Pool (LPs) Trackers and Analytics:

- Below you will find the Top 5 Liquidity Pool (LPs) Trackers and Analytics Providers to get the best overview about the different active Liquidity Pools on different Layer 1 and Layer 2. We hope that these Top 5 Liquidity Pool Trackers and Analytics services will help you to make better Liquidity Pool decisions.

-

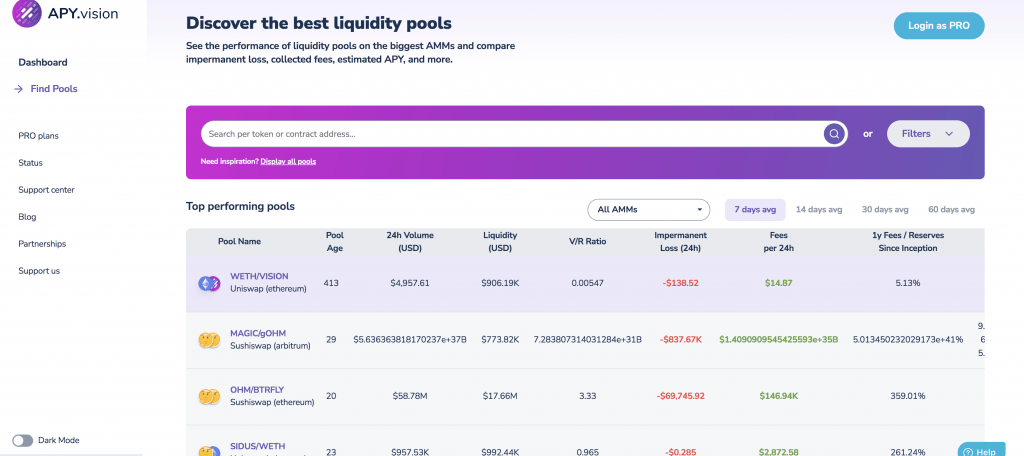

APY.vision

- Follow APY.vision on Twitter

- APY.vision: All-in-one liquidity pool analytics and yield farming rewards tracking tool. Find the most profitable liquidity pools, calculate liquidity pool performance, impermanent losses and track yield farming rewards in one place. APY.Vision offers a two-tiered dashboard to manage your liquidity pools. APY.vision offers different AMMs.

- APY.vision LP Analytics and Tracking Dashboard

-

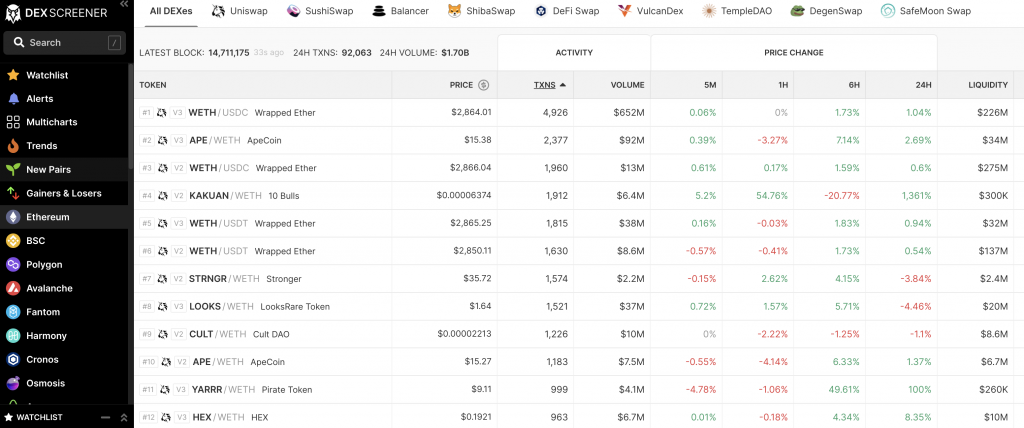

DEXScreener.com

- Follow Dexcreener on Twitter

- Dexscreener: Tracking and charting your favorite DEX in realtime. Dexscreener.com.

- Dexcreener LP Analytics and Dashboard

-

Dexscreener.com Dashboard -

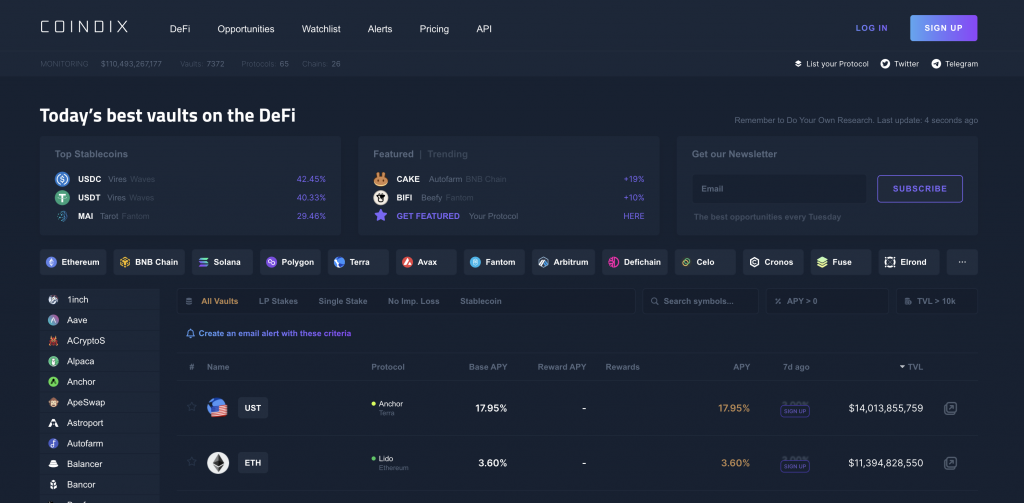

Coindix.com

- Follow Coindix on Twitter

- Coindix: As you know, projects on the DeFi ecosystem are like building blocks. DeFi projects are interoperable and often are built on top of each other, creating infinite possibilities. However, the current DeFi ecosystem is fragmented and difficult to navigate. The mission of Coindix is to gather pieces of the DeFi ecosystem in one place and under one simple and intuitive interface.

- Coindix LP Analytics and Tracking Dashboard

-

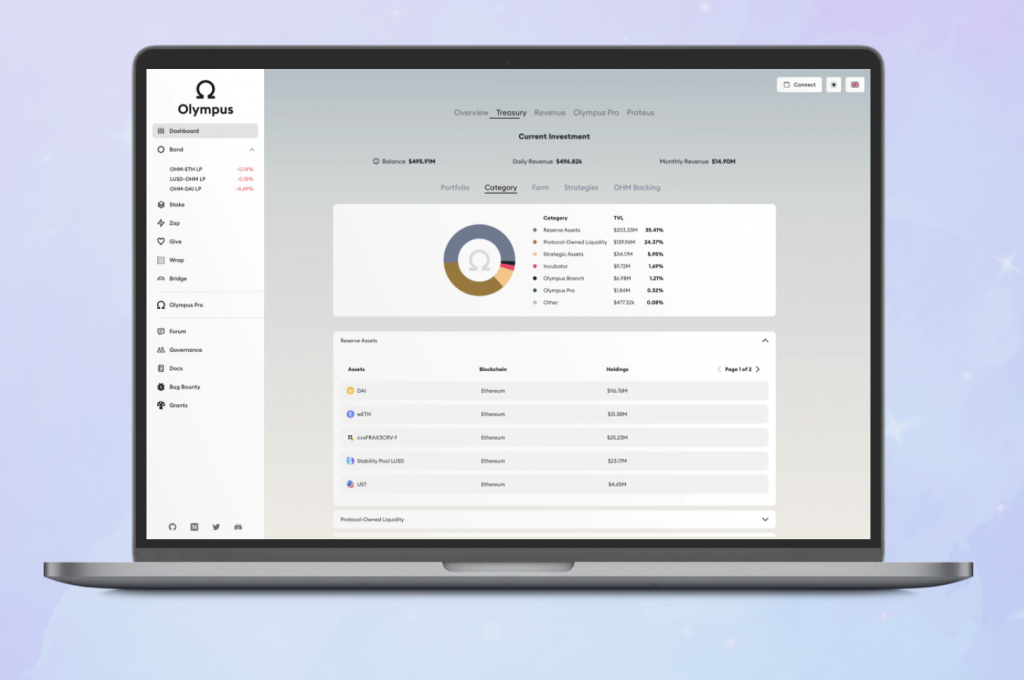

Multifarm

- Follow Multifarm on Twitter

- Multifarm: We believe in the power of DeFi to transform finance and put value back into the hands of individuals. Our goal is to build the go-to platform for DeFi data and DAO tooling, by offering Treasury Dashboards, Yield Farming Dashboards and numerous other fully comprehensive and totally customizable solutions. We’re a constantly growing technical team working at the confluence of finance, smart contracts and data science. Our team has a background from top-academic institutions as well as engineering expertise from big web 2.0 companies.

- Multifarm LP Analytics and Tracking Dashboard

-

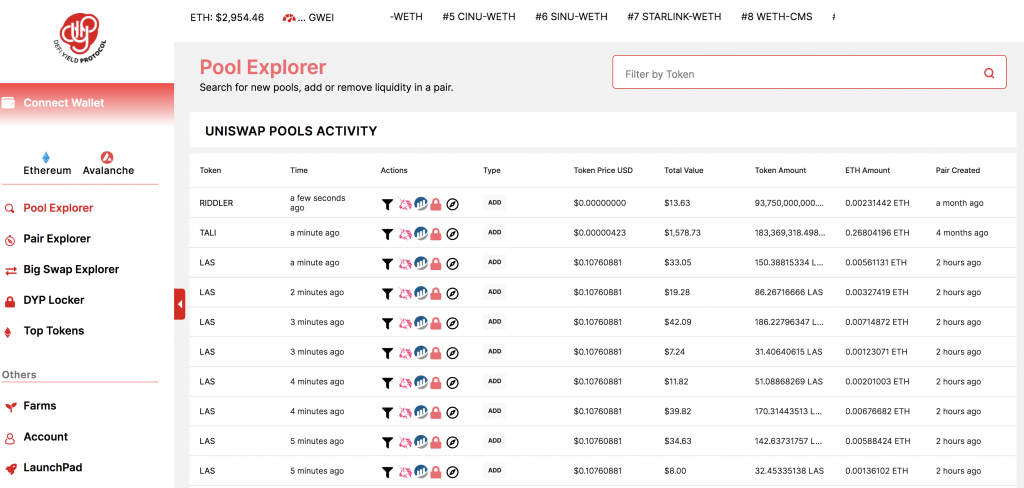

DeFi Yield Protocol

- Follow DPY on Twitter

- DeFi Yiield Protocol: DeFi Yield Protocol is a decentralized platform that people can use for yield farming, staking, and enabling users to leverage the advanced trading tools of the DYP.

- DeFi Yield Protocol LP Analytics and Tracking Dashboard

-

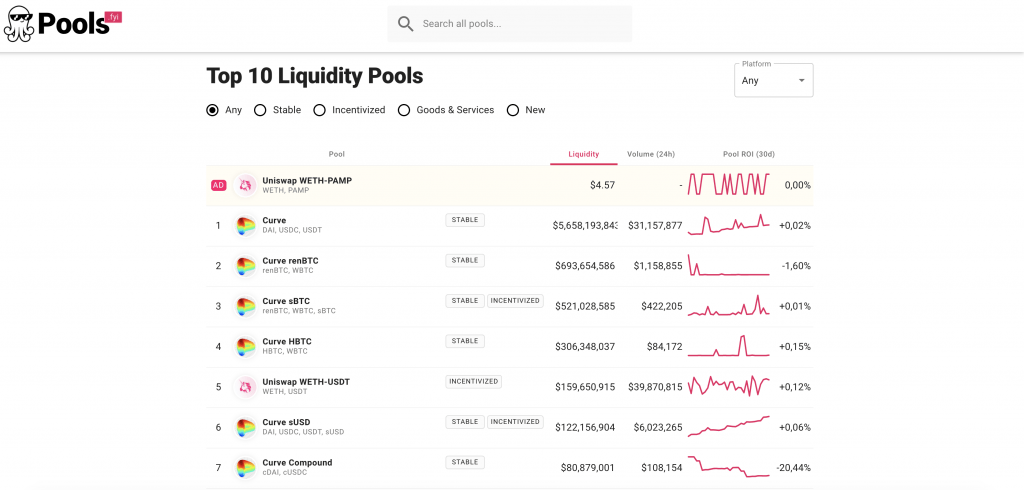

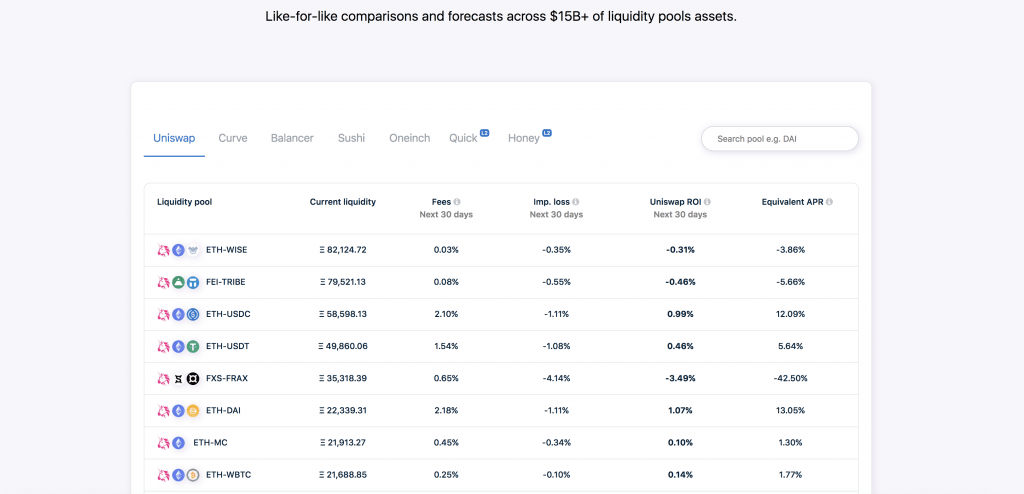

Pools.fyi

- Follow Pools.fyi on Twitter

- Pools.fyi: In Pools.yfi you can find the top liquidity pools across a range of different Automated Money Markets (AMM) with your liquidity positions. Anyone can start earning trading fees on exchange platforms like Uniswap today by being a liquidity provider. Pools fully distribute trading fees to liquidity providers. As a liquidity provider, you add a specific ratio of assets to help faciliate trades in the pool. Doing so gives you an ownership share of the pool and the future trading fees it generates.

- Pools.fyi LP Analytics and Tracking Dashboard

-

Don´t miss any DeFi, NFT or Web3 insights. Get involved in DeFi & NFTs & Web3 for free!

-

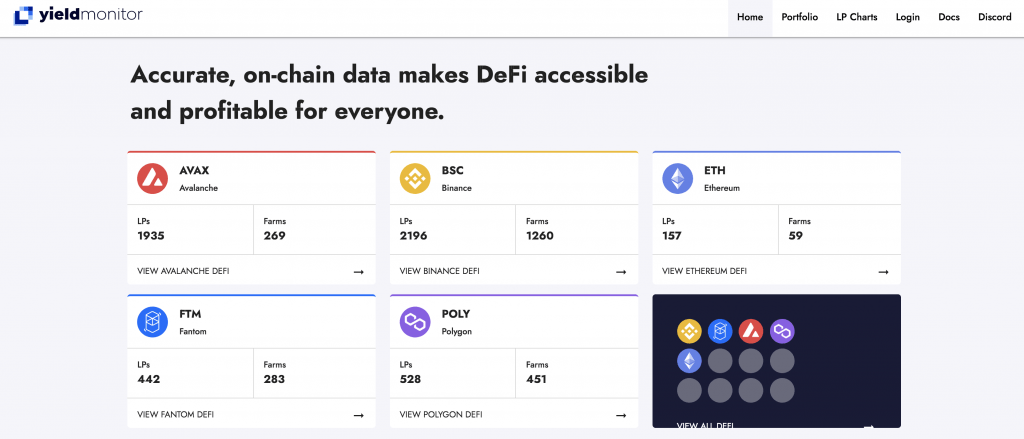

Yieldmonitor.io

- Follow Yieldmonitor on Twitter

- Yieldmonitor: Instant on-chain DeFi data. Multi-chain asset price, volume, trading, and portfolio tracking data for DeFi investors and traders. Institutional-grade database and analytics dashboard toolkit for DeFi product teams and developers. Yield Monitor’s high-powered database feeds on-chain data directly to users and DeFi platforms to keep financial products running smoothly and accurately. Upcoming user analytics tooling will enable builders to offer improved customer experiences.

- Yieldmonitor LP Analytics and Tracking Dashboard

-

Yieldmonitor Dashboard -

Yieldshield.com

- Follow Yieldshield on Twitter

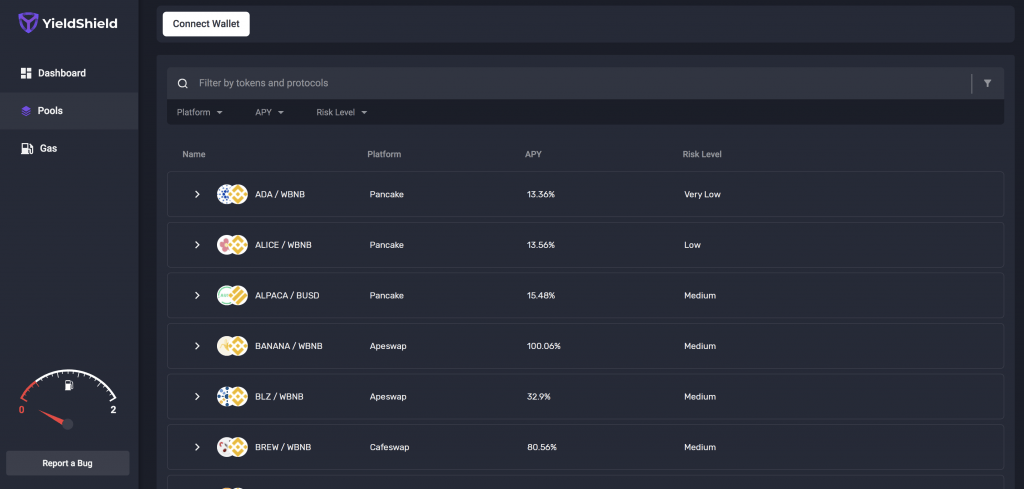

- Yieldshield.com: YieldShield is an automatic and secure yield farming optimization service, built on the Yield Protocol toolset. We deploy smart contracts and AI in a very simple and intuitive user interface, allowing anyone to easily yield farm safely. Our robo-farmer maximizes users’ returns, based on their risk-level settings.

- Yieldshield LP Analytics and Tracking Dashboard

-

Yieldshield Dashboard -

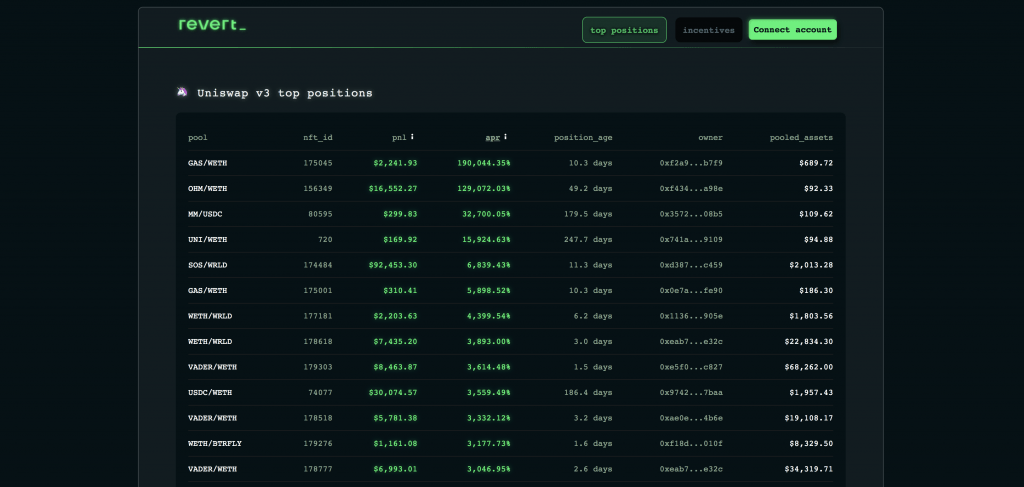

Revert.Finance

- Follow Revert.Finance on Twitter

- Revert Finance: Actionable analytics for DeFi liquidity providers. Revert Finance Liquidity Pools analytics.

- Revert Finance LP Analytics and Tracking Dashboard

-

Liquidityfolio

- Follow Liquidityfolio on Twitter

- Liquidityfolio: Up your game with Liquidity Pools. Join thousands of Liquidity Providers finding the best pools and tracking their returns

across Uniswap, Curve, Balancer, Sushiswap, 1inch and more. - Liquidityfolio LP Analytics and Tracking Dashboard

-

Liquidityfolio Dashboard

- Don´t miss any Liquidity Pool (LPs) insights. Get involved in DeFi & NFTs & Web3 and LPs for free!

-

Make better Liquidity Pool decisions with our Top 5 LP Tracking services!

Summary – Top 5 Liquidity Pool (LPs) Trackers and Analytics

- In this article, we shared the Top 5 Liquidity Pool (LPs) Trackers and Analytic service providers. By using these LP analytic tools and tracking services you can improve your Liquidity Pool knowledge and hopefully make better Liquidity Pool decisions.

- We hope this article helps you with your research about Liquidity Pools and Liquidity Pool tracking services and data analytic tools.

-

Enjoy your Liquidity Provider (LPs) journey with DezentralizedFinance.com!

- Find more valuable information about the Top DeFi Dashboards and DeFi Yield Apps at DezentralizedFinance.com.

- RISK DISCLAIMER: All information presented above is meant for informational purposes only and should not be treated as financial, legal, or tax advice. This article’s content solely reflects the opinion of the writer, who is not a financial advisor. Do your own research before you purchase cryptocurrencies. Any cryptocurrency can go down in value, also to zero. Holding cryptocurrencies, NFTs or digital assers is very risky. You can lose 100% of your funds!

Interesting too

author