Staking Service and Venture Capital Fund

-

Don´t miss any Staking updates & Validator insights – Sign up now!

Staking Service and Venture Captial Fund

- DezentralizedFinance.com is very excited about the Staking industry and the Crypto Venture Capital Funds industry. Both ecosystems work hand in hand together and support each other.

- We are excited about the Staking and Crypto VC ecosystem and we support both industries by creating a lot of content, databases and maps.

- Here you will find our Staking Service map and database with more than 100 Top Staking Providers.

- Here you will find a list of 600 Top Venture Capital Funds.

- Below you will find 3 Top Staking services that founded their own Web3 Venture Capital arm. The volumes of the Web3 funds vary from 17 Mio. USD to 30 Mio. USD.

-

DezentralizedFinance.com supports the Staking and Crypto VC ecosystems!

Top 100 Staking Service Providers Map 2022:

- Find below the updated Staking Service Map 2022 by DezentralizedFinance.com. In total, you will find more than 100 different Staking service providers in our Staking Map and Staking Database.

-

-

Don´t miss any Staking updates & Validator insights – Sign up now!

-

Top 200 Crypto Venture Capital Funds Map 2022:

- Find below the updated Crypto Venture Capital Funds Map 2022 by DezentralizedFinance.com. In total, you will find more than 200 different DeFi/Web3/Crypto Venture Capital companies in our Crypto VC map and database.

-

The best of both worlds:

- Staking service providers support the blockchain ecosystem with their nodes and infrastructure. Crypto Venture Capital firms support the crypto ecosystem with money, network, community – media – reach, and sometimes also legal & tech services and human resources. Staking service providers with its Crypto VC arms combine all of both worlds.

-

We recommend having a look at Staking Service and Venture Capital Fund ecosystems.

-

Don´t miss any Staking updates & Validator insights – Sign up now!

-

In this blog post, we focus on 3 Top Staking services with their Web3 Venture Capital Fund arms:

- There are several Crypto Venture Capital firms and Staking Providers out there which can support Web3 and Open Finance projects in their seed stage with more than capital. Most of these supporters offer a network, legal advice, explorer & tooling, early liquidity, content, tutorials and much more.

- Below you will find some bullet points regarding the service offering of a staking service provider with a venture capital arm included.

-

What support can you expect from a Staking Provider and their Venture arms?

-

Funding for your seed stage Web3 and Open Finance project

-

Team support from prototype to testnet to mainnet

-

Validate your MVP

-

Strategic long-term partner

-

Skin in the game – infrastructure & capital

-

Highly performant, secure Staking infrastructure

-

Blockchain tooling & applications

-

Blockchain Explorer and Staking indexer

-

Testnet & Mainnet support

-

Governance proposals / votes

-

Content & Education partner

-

Valuable Community tools and events

-

Long-term liquidity provider

-

Which Investment thesis is supported?

-

Multichain & Interoperability

-

Applications & Onboarding to Web3

-

Web3 infrastructure

-

Open & Decentralized Finance

-

New Layer 1 & 2

-

Privacy and Identity

-

Data & Oracles

-

NFT & Metaverse technology

-

Don´t miss any Staking updates & Validator insights – Sign up now!

-

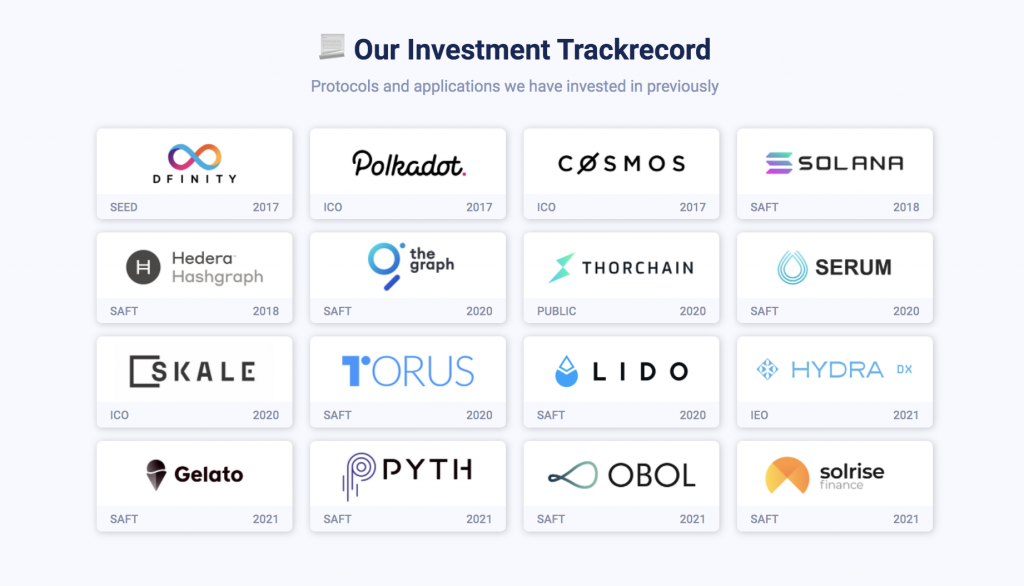

1. StakingFacilites Ventures

- Story: ONBOARD A BILLION USERS TO WEB 3.0. We believe ecosystems around permissionless layer one blockchains based on Proof-of-Stake offer the chance to bring the vision of Web3.0 into the hands of billions. We want to help make that happen.

-

Website link Staking Facilities Ventures -

Web3 Fund announcement -

Web3 Venture Capital volume: 25 Mio. USD

-

StakingFac Ventures description -

StakingFac Ventures services -

Staking Fac Ventures portfolio -

Staking Fac Ventures team

-

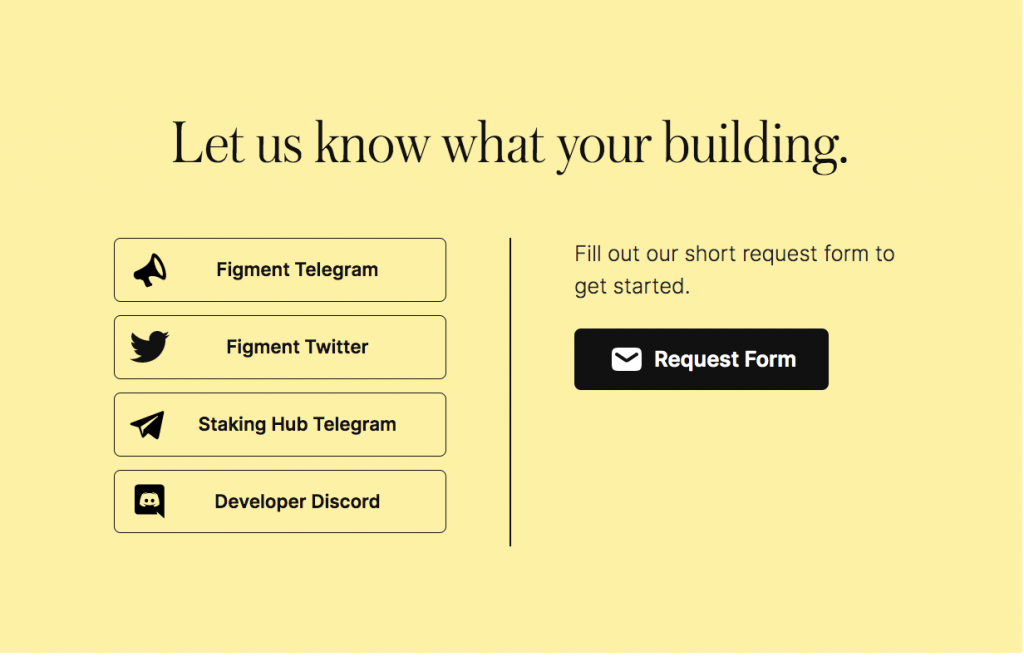

2. Figment Ventures

- Story: Figment Fund I, LP (the “Fund”) is the inaugural investment fund organized and managed by Figment VC. The venture capital fund has raised $17.5M to invest in early-stage Proof-of-Stake networks. Figment VC invests in founders that will make strong long-term partners and leverages its industry expertise to assist in scaling their networks.

-

Website link Figment Ventures -

Web3 Fund announcement -

Web3 Venture Capital volume: 17 Mio. USD

-

Figment Ventures announcement -

Figment Ventures – More than a VC -

Figment Ventures contact

-

3. Chorus One Ventures

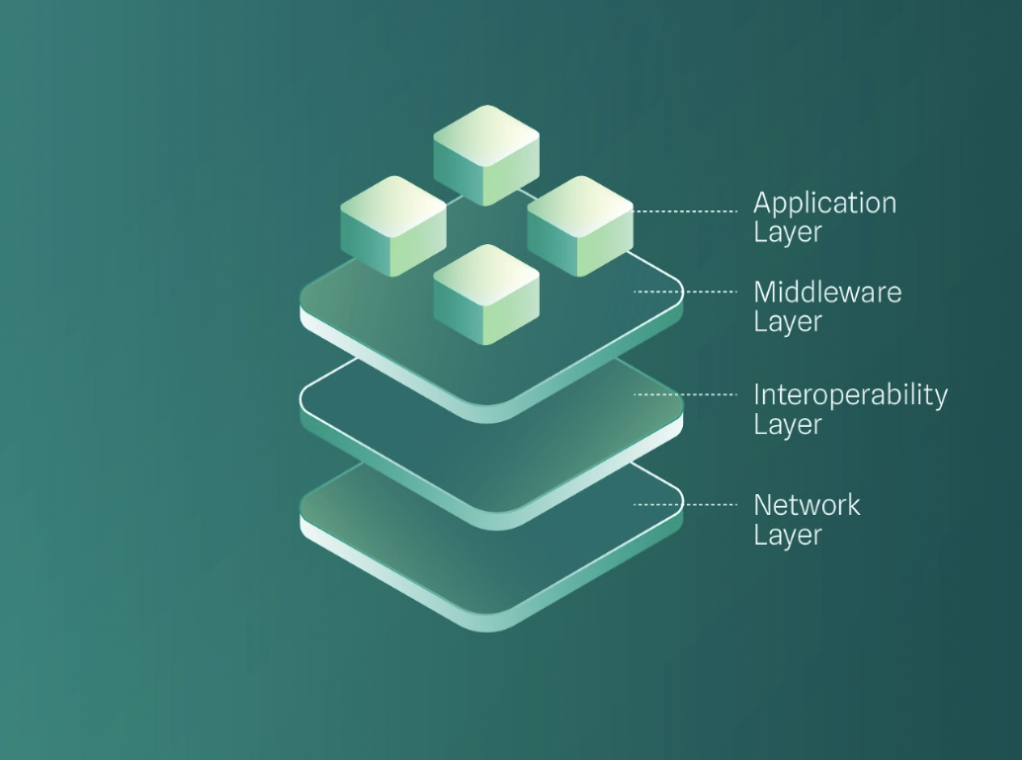

- Chorus One Thesis: Chorus Ventures is investing in Proof-of-Stake networks, interoperability and middleware protocols and products. We believe at least 10% of humanity’s economic activity will run through PoS in 10 years’ time bringing freedom and prosperity through open and transparent decentralized networks. We leverage our multidimensional relationships with network ecosystem participants and expertise in node infrastructure operations to connect and secure our portfolio of networks.

-

Website link Chorus One Ventures -

Web3 Fund announcement -

Web3 Venture Capital volume: up to 30 Mio. USD

-

Chorus One Ventures announcement -

Chorus One Ventures -

Chorus One Ventures verticals -

Chorus One Ventures middleware -

Chorus One Ventures layers -

Chorus One Ventures contact

Summary – Staking Service and Venture Captial Fund:

- The combination of Staking service providers with its nodes and blockchain infrastructure and the services of a Crypto/Web3 Venture Capital Funds can be very exciting for the need of early-stage seed projects. The service range of companies like StakingFacilites Ventures, Chorus One Ventures or Figment Ventures can be very attractive for Web3, DeFi, OpenFinance, and Metaverse teams.

- DezentralizedFinance.com supports both worlds, the Staking industry and the Crypto Venture Capital industry with our content and newsletters and we like companies that combine the best of both worlds.

-

Staking Service and Venture Captial Fund ecosystems are very interesting combinations!

- Find more valuable information about the Top Staking Services and the Top Crypto and Web3 Venture Capital Funds at DezentralizedFinance.com.

- RISK DISCLAIMER: All information presented above is meant for informational purposes only and should not be treated as financial, legal, or tax advice. This article’s content solely reflects the opinion of the writer, who is not a financial advisor. Do your own research before you purchase cryptocurrencies. Any cryptocurrency can go down in value, also to zero. Holding cryptocurrencies, NFTs or digital assets is very risky. You can lose 100% of your funds!

Interesting too

author