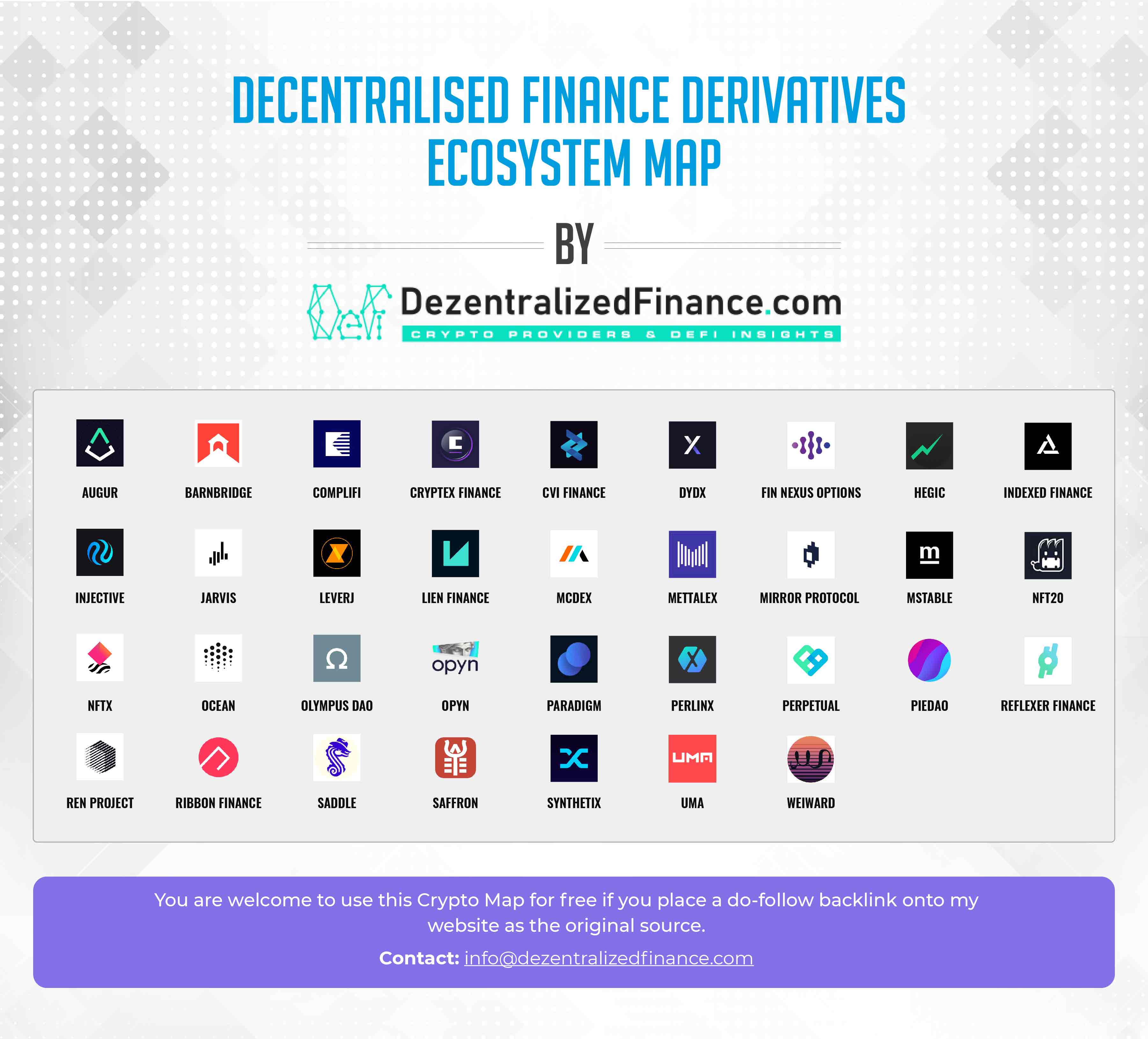

Decentralised Finance Derivatives Ecosystem Map

Decentralised Finance Derivatives Ecosystem

Best Crypto | DeFi | Web3 Ecosystem

Maps and Databases.

Find all important crypto projects & networks in seconds.

Don´t miss any updates!Don´t miss any Crypto updates and DeFi insights - Sign up now!

Don´t miss any Crypto updates and DeFi insights – Sign up now!

Decentralised Finance Derivatives Ecosystem Database

Latest Articles

- Top 10 Ethereum consensus and execution clients March 31, 2023

- Wallet Wars 2023 – Upcoming Crypto & Smart Contract wallet infrastructure services March 24, 2023

- Top Web3 Community Support Solutions January 22, 2023

- Top 3 Staking and Validator Ecosystem Maps December 21, 2022

- Interview with Paul Faecks | Alloy Capital December 19, 2022

- Top 130 Staking Validators December 13, 2022

- Top 10 Crypto and Web3 Ecosystem Maps December 7, 2022

- SUI Network Ecosystem Projects | New Layer 1 November 27, 2022

- Best 40 Web3 and Crypto accelerator programs November 23, 2022

- Best 50 European Web3 Infrastructure Service Providers November 21, 2022

Most Read

- Top 80 Crypto VCs by Julian Richter August 18, 2021 (30,580)

- Top 5 Liquidity Pool Trackers and Analytics by Julian Richter January 10, 2022 (8,528)

- Best 130 Crypto Venture Capital Companies by Julian Richter November 1, 2021 (8,527)

- Top 5 NFT Analytics Platforms by Julian Richter January 1, 2022 (5,670)

- Polkadot Ecosystem Overview by Julian Richter September 10, 2021 (4,570)

- TOP 10 DeFi Reports by Julian Richter July 15, 2021 (4,158)

- Best 90 Crypto OTC Trading Desks by Julian Richter October 25, 2021 (4,110)

- Top 15 DeFi Dashboards by Julian Richter August 23, 2021 (2,714)

- Cosmos Network Ecosystem Overview by Julian Richter June 15, 2021 (2,644)

- Cosmos Network Projects by Julian Richter December 4, 2021 (2,594)

Staking News

- June 7, 2022

- May 31, 2022

- April 27, 2022

- April 23, 2022

- December 28, 2021

- December 20, 2021

Latest Interviews

- December 19, 2022

- November 14, 2022

- October 11, 2022

- April 8, 2022

- April 3, 2022

- March 18, 2022

DeFi News

- March 31, 2023

- 0

- DeFi News

Top 10 Ethereum consensus and execution clients

- January 22, 2023

- 0

- DeFi News

Top Web3 Community Support Solutions

- December 21, 2022

- 0

- DeFi News

Top 3 Staking and Validator Ecosystem Maps

- December 19, 2022

- 0

- DeFi News,Interviews

Interview with Paul Faecks | Alloy Capital

- December 13, 2022

- 0

- DeFi News

Top 130 Staking Validators

- December 7, 2022

- 0

- DeFi News

Top 10 Crypto and Web3 Ecosystem Maps

- November 27, 2022

- 0

- DeFi News

SUI Network Ecosystem Projects | New Layer 1

- November 23, 2022

- 0

- DeFi News

Best 40 Web3 and Crypto accelerator programs

- November 21, 2022

- 0

- DeFi News

Best 50 European Web3 Infrastructure Service Providers

- November 14, 2022

- 0

- DeFi News,Interviews

Interview with Alexander Lenz | SMAPE Capital

- October 16, 2022

- 0

- DeFi News

Top 25 Web3 News Pages

Interviews

- December 19, 2022

- 0

- DeFi News,Interviews

Interview with Paul Faecks | Alloy Capital

- November 14, 2022

- 0

- DeFi News,Interviews

Interview with Alexander Lenz | SMAPE Capital

Highlighted Digital Custodian

Market-leading solution for your digital assets.

Reliable white-label blockchain custody suite since 2018.

- White-Label Custody

- Warm – and Cold-Wallet Suite

- Wallet-as-a-Service

- Made in Germany

- Supervised by BaFin

- API & cloud-first strategy

- Crypto and Tokenization Custodian

- Insured Custody Suite

- Custody of Top 30 Blockchains

- Staking for Top 30 Tokens, also Solana and Polkadot

Get in touch with Tangany!

Don´t miss any Crypto updates and DeFi insights – Sign up now!

(Visited 889 times, 1 visits today)